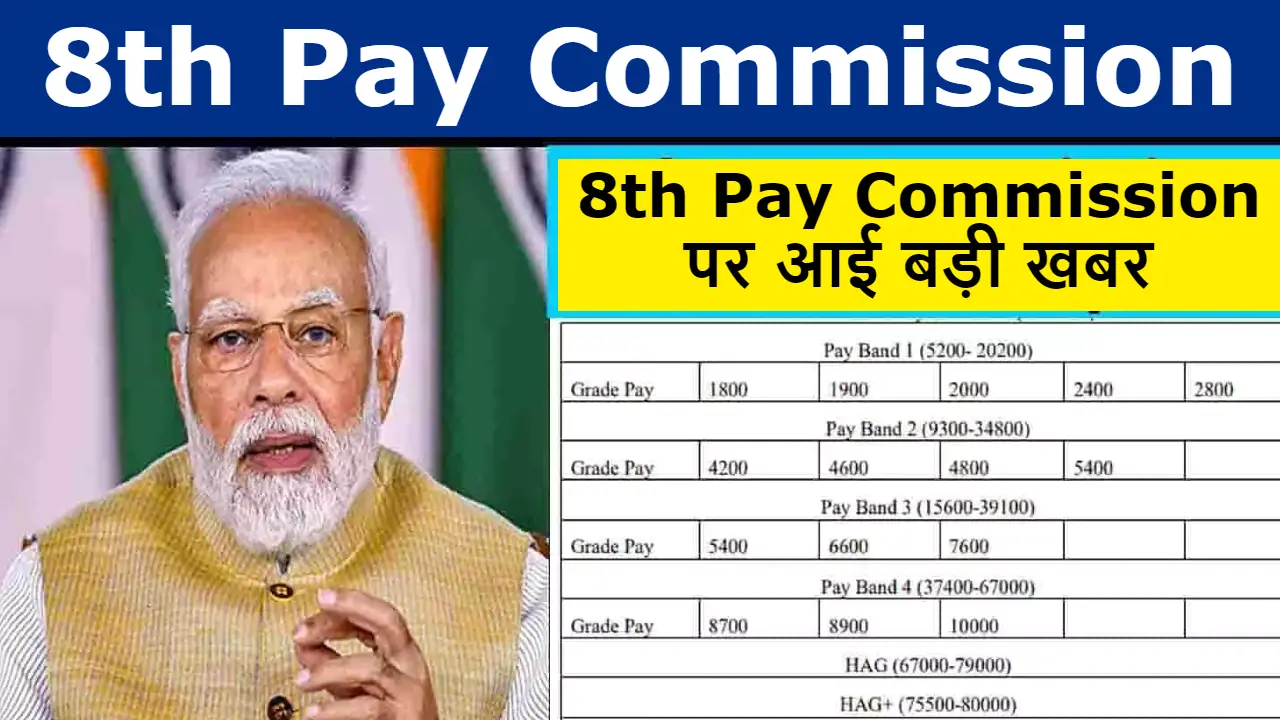

8th Pay Commission Approved by Government

Cabinet clears setting up of 8th Pay Commission for central govt employees. The decision to set up the 8th Pay Commission was taken at a meeting of the cabinet chaired by Prime Minister Narendra Modi.

NEWS:- On Thursday, the central government approved the constitution of the 8th Central Pay Commission to review and recommend salary adjustments for central government employees, which will submit its report by 2026. A chairman and two members will be appointed to oversee the rollout.

Union Minister Ashwini Vaishnaw announced the decision on Thursday, 16 January.

While the Cabinet has approved, the date for setting up the commission has not been disclosed.This development comes just ahead of the Union Budget 2025 and is expected to bring a salary hike for government employees and retirees.

PAY COMMISSION HISTORY

A Pay Commission is an official panel established by the government to assess and propose wage frameworks for Central government employees.

Over the course of India’s history since Independence, seven Pay Commissions have been convened, with each one typically covering a ten-year period. The 7th Pay Commission was established in 2016 and its term will end in 2026. The recommendations put forth by these commissions have significant implications on the earnings and quality of life for countless employees and retired individuals. Previous pay commissions have aimed to adjust salaries, pensions, and allowances in line with economic changes.

PAY COMMISSIONS TIMELINE 1) 1st Pay Commission : 1946 2) 2nd Pay Commission : 1959 3) 3rd Pay Commission : 1973 4) 4th Pay Commission : 1986 5) 5th Pay Commission : 1996 6) 6th Pay Commission : 2006 7) 7th Pay Commission : 2016 8) 8th Pay Commission : Expected by 2026

ECONOMIC IMPACT

Exchequer Impact – Implementing pay commission recommendations is expensive. The 7th Pay Commission resulted in Rs.1.02 lakh crore impact on the exchequer in 2017. This increase in spending can strain public finances. However, it also boosts consumer spending. Higher salaries mean more disposable income. This can drive demand for goods and services, helping the economy.

| Details | 6th Pay Commission | 7th Pay Commission |

| Implementation Year | 2006 | 2016 |

| Pay Bands & Grade Pay | Introduced pay bands and grade pay system | Replaced pay bands and grade pay with a simplified pay matrix |

| Minimum Pay | Rs. 7,000 per month | Rs. 18,000 per month |

| Maximum Pay | Rs. 80,000 per month (for Secretary level] | Rs. 2.5 lakh per month (for Cabinet Secretary) |

| Fitment Factor | Approx. 1.86 times the basic pay | 2.57 times the basic pay |

| Allowances | Rationalized, with a significant focus on HRA and other perks | Rationalized further, with HRA and other allowances restructured |

| Gratuity Ceiling | Rs. 10 lakh | Rs. 20 lakh, with provision for periodic increases based on DA |

| Pension | Revised with an option for additional pension post-retirement age | Minimum pension set at Rs.9,000 per month, with adjustments for inflation |

| Dearness Allowance (DA) | Introduced based on inflation index | Continued, with periodic updates |

8TH PAY COMMISSION

The 8th Pay Commission is expected to build upon the reforms introduced by the 7th Pay Commission, which was implemented in January 2016 and will conclude its recommendations by the end of 2025.

Reports suggest a possible increase in the fitment factor from 2.57 to 2.86, a key parameter in calculating revised salaries. The fitment factor determines how much the basic pay is multiplied to calculate revised salaries and pensions.

If the 2.86 fitment factor is adopted, salaries and pensions could see substantial hikes.

The minimum salary of government employees could rise to Rs. 51,480, compared to the current Rs. 18,000. Similarly, pensions might increase to Rs. 25,740, a significant jump from Rs. 9000.

Minimum Salary:- Demand to revise the minimum salary to Rs. 32,500 based on Dr. Aykroyd formula.

In that case, the central government employees might see a 186% jump in their minimum salaries.

However, this is just a speculation. The exact amount will be known only after the 8th Pay Commission report

EXPECTATIONS FROM 8TH PAY COMMISSION

- Higher Minimum Salary: Unions are demanding an increase from Rs 18,000 to Rs 26,000-Rs 30,000 per month. Rising inflation and living costs are the main reasons.

- Fitment Factor: The current fitment factor is 2.57. This could rise to 2.86. The fitment factor determines how salaries are adjusted.

- Dearness Allowance (DA): Employees get DA twice a year to offset inflation. The new commission may suggest making DA more responsive to inflation.

- Pension Changes: Pensioners, especially those who retired before the 7th Pay Commission, could benefit from revisions. Parity in pensions is a longstanding demand.

- Housing and Travel Allowances: The commission may update House Rent Allowance (HRA) and Travel Allowance (TA) to reflect current costs.

NEW MECHANISM? In Parliament, the Ministry of Finance recently said that the 8th Pay Commission is “presently not under consideration.” This has fuelled speculation. Could the government introduce a new system to revise salaries? Some key government officials suggest linking salary revisions to performance or inflation instead of forming a new commission.

The government may adopt a performance-based system or one tied to inflation rates.

This would allow for regular salary adjustments without waiting for a decade.

ARGUMENTS IN FAVOR FOR PERFORMANCE-BASED SYSTEM

- Enhanced Productivity: Performance-based pay can motivate employees to improve efficiency and deliver better results.

- Accountability: It ensures that employees take responsibility for their work, reducing complacency in government roles.

- Recognition of Merit: High-performing employees get rewarded, fostering a culture of excellence and fairness.

- Alignment with the Private Sector: Many private organizations successfully use performance-linked incentives, which could inspire similar success in government sectors.

- Efficient Resource Utilization: Taxpayer money would be better justified if linked to tangible outputs or measurable contributions.

ARGUMENTS AGAINST FOR PERFORMANCE-BASED SYSTEM

- Measurement Challenges: It’s difficult to objectively measure performance in roles that involve public service or policymaking, as results may depend on external factors.

- Risk of Favoritism: Without transparent and robust evaluation mechanisms, there’s a risk of biased or unfair assessments.

- Job Security Issues: Linking pay to performance could erode the sense of security that government jobs traditionally provide, making them less attractive.

- Reduced Collaboration: Employees may prioritize individual results over teamwork, which could harm overall efficiency.

- Ethical Concerns: In roles involving sensitive decision-making, performance-based pay might encourage shortcuts or corruption to achieve targets.

If you want any information or have any queries related to the 8th Pay Commission – do contact us or leave a comment below.

Post Comment